Umeå School of Business and Economics

Department of Business Administration

Master Thesis Spring 2006

Supervisor: Åke Gabrielsson

Authors:

Björn Backgård

- The Development and Evaluation of the SMART Investment Model -

PREFACE

Before anything else we would like to thank those who made it possible for us to avoid the

sunlight for such a long time, SIX1 and their database SIX Trust. We would especially like to

thank Henrik Röhs at SIX because without his help this thesis would simply not have been

possible. We would also like to thank our supervisor Åke -Method Man- Gabrielsson for

sharing his great knowledge in the field of scientific methodology and science philosophy and

for pushing us - two pragmatic fools maybe not ideally suited for the academic world -

towards putting more effort into the chapter on methodology.

1 SIX, http://www.six.se/ (2006-04-29)

ABSTRACT

In this thesis we examine the Swedish stock market to evaluate a trading strategy exploiting

three anomalies known to exist in markets all over the world. The first anomaly is the size

effect meaning that small cap stocks tend to outperform large cap stocks over longer time

periods. The second is the book-to-market (B/P) effect or that firms with high book values

relative to their market value historically have provided greater shareholder returns than firms

with low book values relative to market value. The third anomaly that our model tries to profit

from is the observation that shares having performed well over the last 3 to 12 months

perform better than firms that have performed badly over this time period. We investigate the

presence of these anomalies on the Swedish stock market over the years 1995-2005 and also

try to find out if there are any interrelations between them that can be used in stock selection

and portfolio formation.

Our model for stock selection first divides the available shares into two groups: small cap and

large cap. These two groups are then separated into three subgroups based on their book-to-

market values and these are finally divided into winner and loser portfolios. Each year

between 1995 and 2005 (data included from 1994) we form 12 different portfolios of shares

from the Swedish A-list and compare the returns gained by holding these. All data on size,

book-to-market ratios and momentum as well as returns are collected from the SIX-Trust

database, index returns were obtained from the website of Stockholmsbörsen. Because of

missing data and short periods of listing, we were not able to include all stock from all years

but we managed to include a total of 678 observations of stock data in our sample which

should yield reliable results. The formation of the SMART-model was based on the findings

of many well renowned papers on market anomalies. The way in which we wished to

contribute to the vast amount of anomaly research was to see if the SMART model could

exploit any interrelations between the three anomalies that are part of it, furthermore we

wanted to contribute to the limited amount of research on momentum effects on the Swedish

stock market.

The results of our study were not entirely in line with theory but the SMART-model still

proved to be quite effective. Even though the portfolio expected to perform the best proved

only to be the third best portfolio over the 11 years, it still outperformed the portfolio

expected to be the least effective by more than 20 %. Ranking the portfolios after their

Sharpe-ratios, the predicted winner steps up to a second place with a ratio of .68 compared to

that of - 0,17 for the predicted loser. We also find that that the portfolio formation of the

SMART-Model exploits some interrelationships between the three anomalies: The difference

in return of the portfolios mentioned above is over 20 % while the average difference between

stocks with small and large size, high and low book-to-market and winners and losers is only

just over

4 %. The three anomalies: the size effect, the book-to-market effect and the

momentum effect were also identified to exist in our study, but only B/P was strong enough to

be statistically significant. However, in contrast to what theory predicts, firms with medium

book-to-market values performed worse than those with low ratios. Combining the anomalies

into the SMART-Model proves to be more effective than separately exploiting the anomalies.

This shows that the model can indeed be a useful tool for forming portfolios and that we have

discovered some interesting interrelationships which we suggest further research on.

Index

1 INTRODUCTION

1

1.1 BACKGROUND

1

1.2 PROBLEM DISCUSSION

3

1.3 OBJECTIVE

3

1.4 DELIMITATIONS

3

1.5 TARGET AUDIENCE

4

1.6 DISPOSITION

4

2 METHODOLOGY

5

2.1 PRECONCEPTIONS

5

2.2 SCIENTIFIC IDEALS

5

2.3 SCIENTIFIC APPROACH

6

2.4 CONTRIBUTION

6

2.6 LITERATURE SEARCH

6

2.6.1 Source criticism

7

3 THEORY AND THE SMART MODEL

8

3.1 THEORIES

8

3.2 MODELS

8

3.3 THE CAPITAL ASSET PRICING MODEL

8

3.4 THE FAMA AND FRENCH THREE-FACTOR MODEL

10

3.5 MARKET EFFICIENCY

11

3.6 THE SIZE EFFECT

12

3.6.1 Summary of findings regarding the size effect

13

3.7 THE MOMENTUM EFFECT

13

3.7.1 Behavioural explanations for the anomaly

14

3.7.2 Empirical evidence of the price momentum effect

15

3.7.3 Summary of empirical findings

17

3.8 THE ANOMALY RATIO

17

3.8.1 Summary on the Anomaly Ratio

21

3.9 INTRODUCTION TO THE SMART MODEL

22

3.9.1 Motives for selecting the three specific factors Size, Momentum and B/P

22

3.10 SMART (SIZE-, MOMENTUM- AND ANOMALY RATIO -TECHNIQUE)

23

3.10.1 SMART METHOD FOR SORTING PORTFOLIOS

24

3.10.2 OTHER SIMILAR RESEARCH

25

3.11 RISK MEASURES FOR SMART

26

3.11.1 Standard deviation

26

3.11.2 Sharpe ratio

27

3.11.3 Reasons for selecting the Sharpe ratio

27

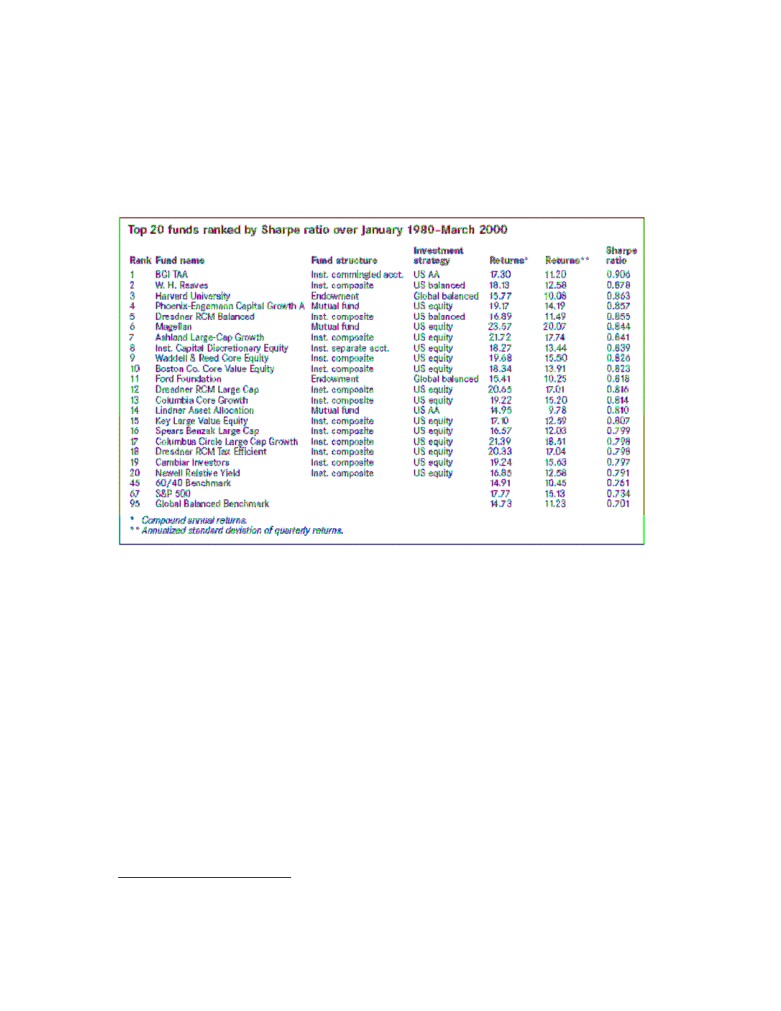

3.11.4 Example of the Sharpe ratio

28

3.12 HYPOTHESES

28

4 DATA MANAGEMENT AND TREATMENT

30

4.1 DATA MANAGEMENT

31

4.2 POTENTIAL PROBLEMS REGARDING PORTFOLIO CREATION

31

5 EMPIRICAL EVALUATION OF THE SMART MODEL

35

5.1 SMART 1995

35

5.2 SMART 1996

35

5.3 SMART 1997

36

5.4 SMART 1998

36

5.5 SMART 1999

37

5.6 SMART 2000

37

5.7 SMART 2001

38

5.8 SMART 2002

38

5.9 SMART 2003

39

5.10 SMART 2004

39

5.11 SMART 2005

40

5.12 SMART MEAN RESULTS 1995-2005

40

5.13 SMART SHARPE RATIO 1995-2005

41

5.14 CORRELATION ANALYSIS FOR 1995-2005

42

5.14.1 Correlations calculation with actual-values 1995-2005

43

6 ANALYSIS

44

6.1 ANALYSIS OF THE RESULTS

44

6.1.1 Bringing Sharpe into the picture

45

6.1.2 Evaluation of interrelations

46

6.1.3 Findings regarding B/P volatility

48

7 CONCLUSION

49

7.1 THE IMPORTANCE OF COMBINATIONS

51

7.2 OUR OWN SPECULATIONS ABOUT THE REASONS FOR THE ANOMALIES

52

7.2.1 The Size effect according to us

52

7.2.2 The B/P effect according to us

52

7.2.3 The Momentum effect according to us

52

7.3 CONCLUDING REMARKS

53

7.4 SUGGESTIONS FOR FURTHER RESEARCH

53

8 VALIDITY AND RELIABILITY

54

8.1 RELIABILITY

54

8.2 VALIDITY

54

8.3 TRANSFERABILITY

55

8.4 TESTING FOR SURVIVORSHIP BIAS

55

8.5 ANALYSIS OF MISSING DATA

56

9 BIBLIOGRAPHY

58

9.1 ARTICLES

58

9.2 INTERNET

60

APPENDIX A - DIAGRAMS

62

Figures

Figure 3:1 Diversifiable risk and Systematic risk, p. 9

Figure 3:2 Security Market Line (SML), p. 9

Figure 3:3 Momentum, p. 14

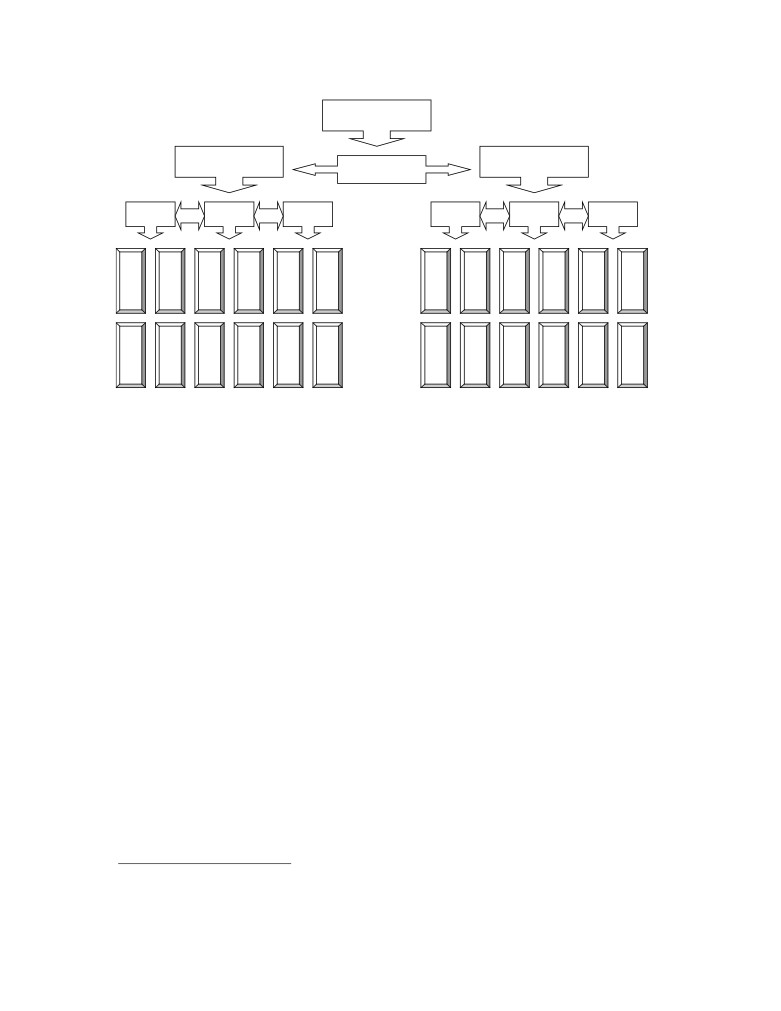

Figure 3:4 SMART method for sorting portfolios, p. 25

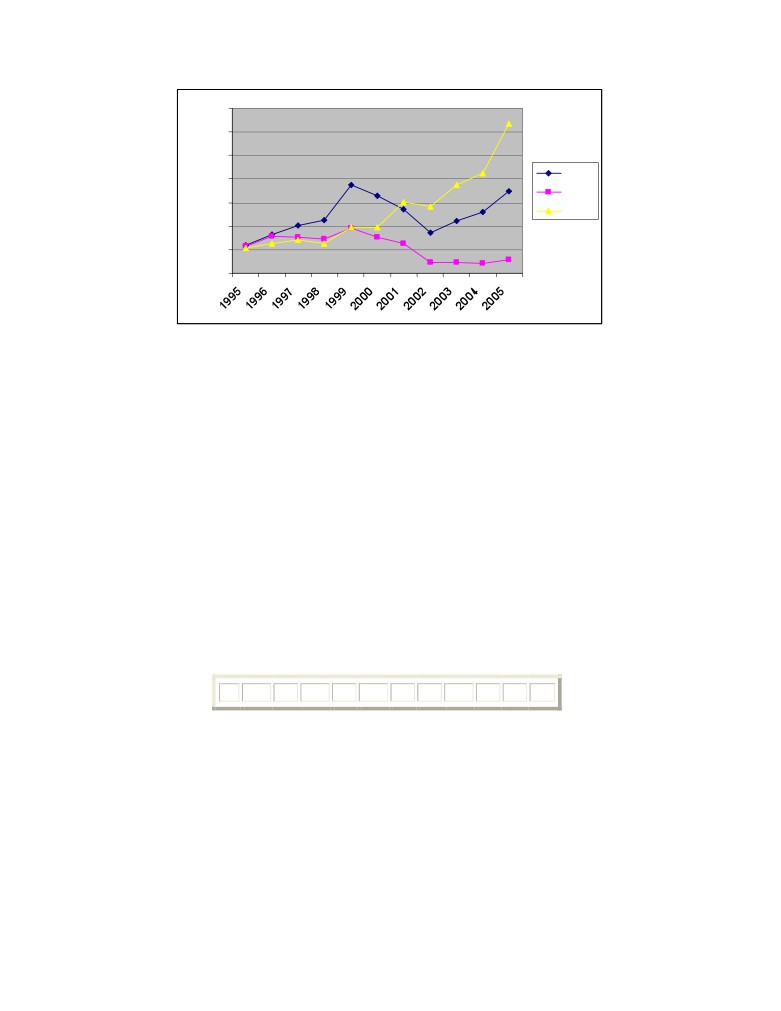

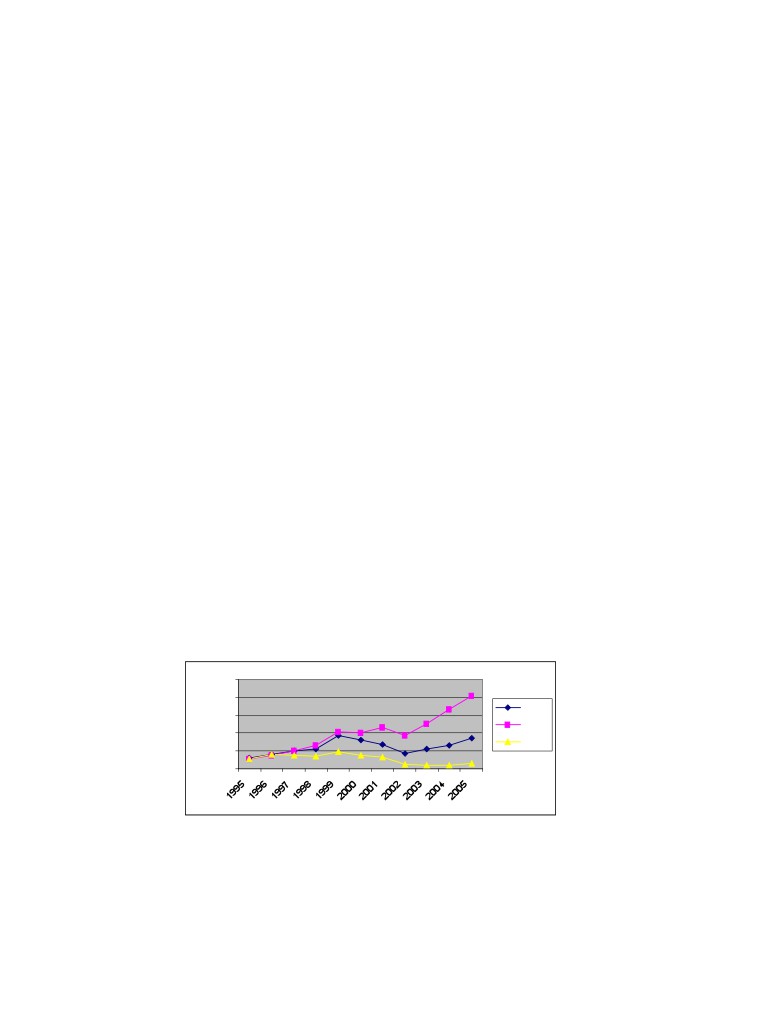

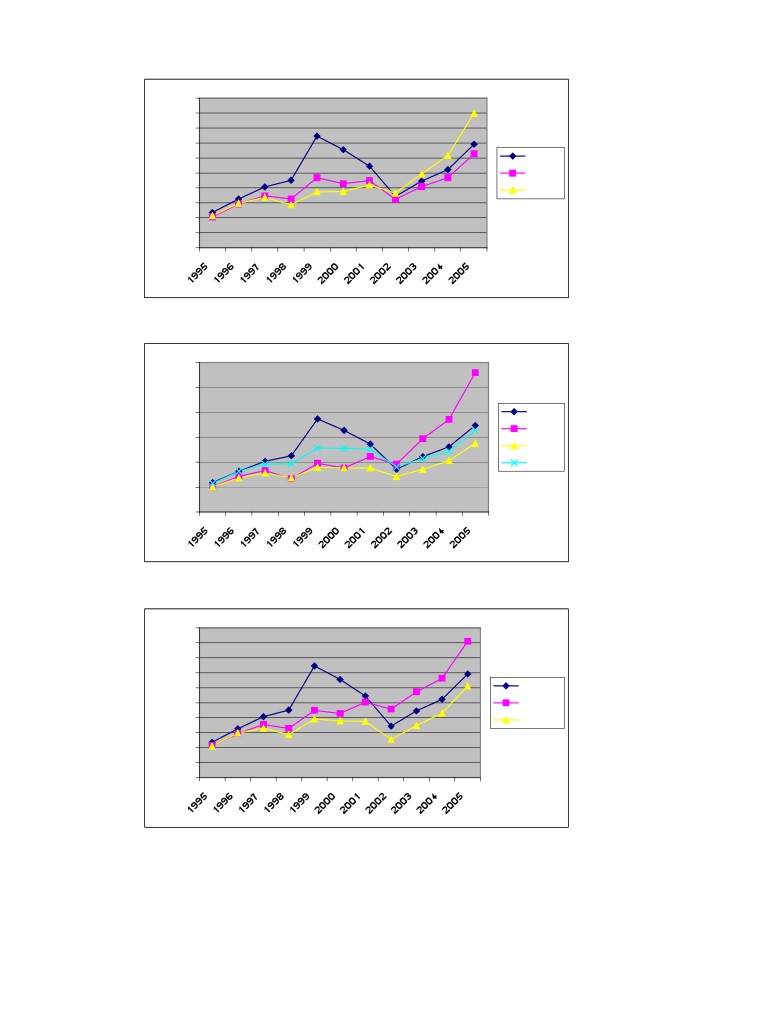

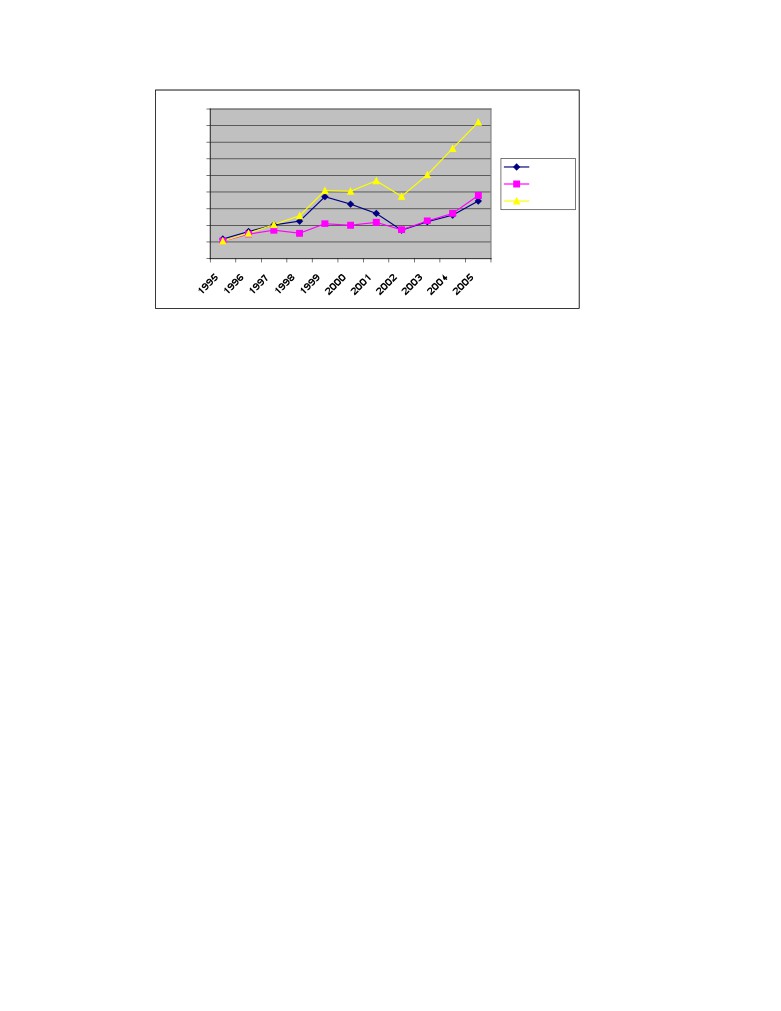

Figure 5:1 Total return from starting value of 100 for SMART (all portfolios), L-L-H and AFGX, p. 41

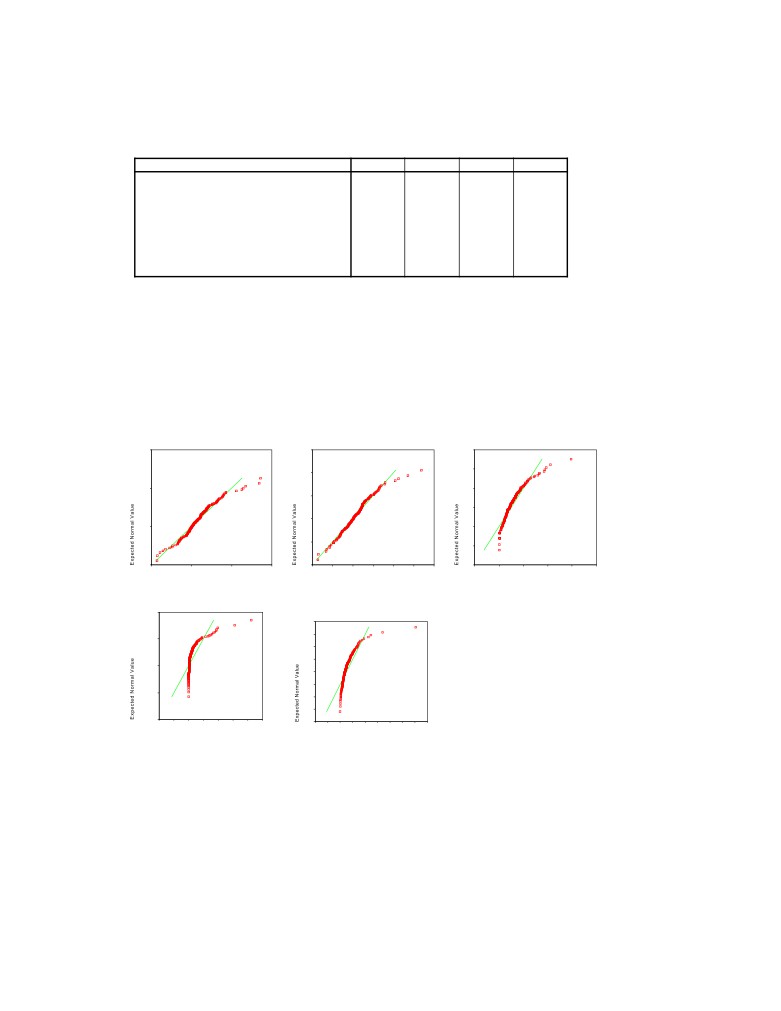

Figure 5:2 Normal QQ plot for factors, p. 42

Figure 6:1 Total return from starting value of 100 for S-H-H, L-L-L, AFGX, p. 46

Figure 6:2 Total return from starting value of 100 for L-L-H, L-L-L, AFGX, p. 58

Tables

Table

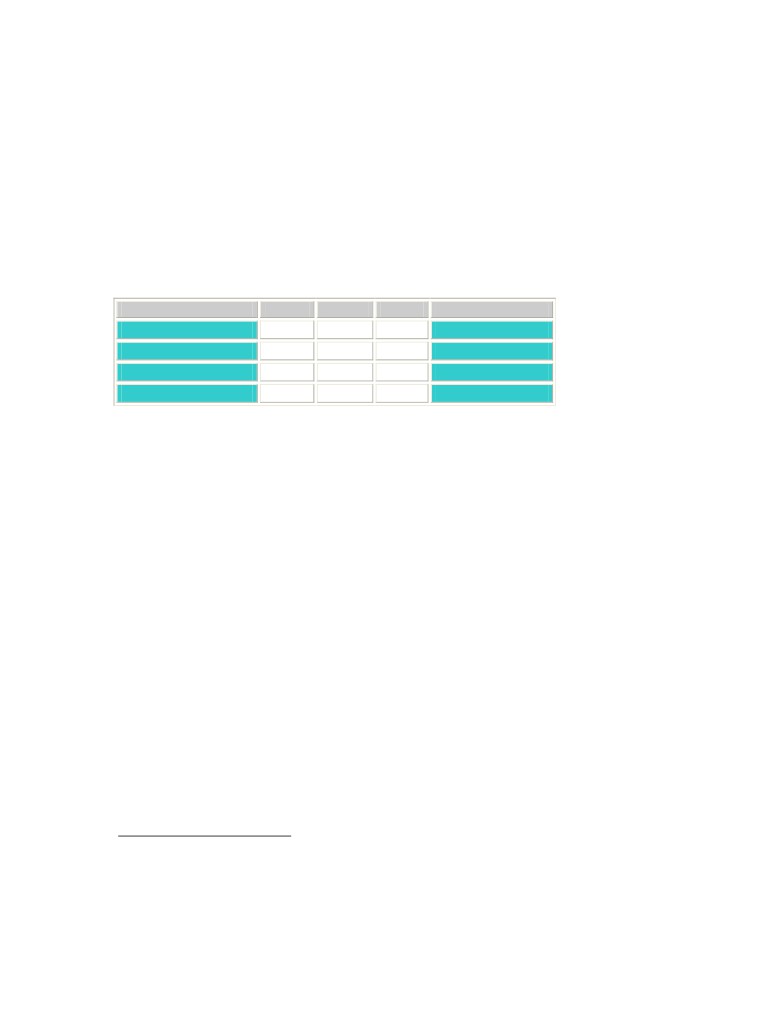

3.1 SMART portfolio combinations, p. 24

Table

3.2 Top 20 US funds ranked by the Sharpe ratio, p. 28

Table

5.1 SMART 1995, p. 35

Table

5:2 SMART 1995 Ranking of portfolios, p. 35

Table

5:3 SMART 1995 Mean of main factors, p. 35

Table

5.4 SMART 1996, p. 35

Table

5:5 SMART 1996 Ranking of portfolios, p. 35

Table

5:6 SMART 1996 Mean of main factors, p. 35

Table

5.7 SMART 1997, p. 36

Table

5:8 SMART 1997 Ranking of portfolios, p. 36

Table

5:9 SMART 1997 Mean of main factors, p. 36

Table

5.10 SMART 1998, p. 36

Table

5:11 SMART 1998 Ranking of portfolios, p. 36

Table

5:12 SMART 1998 Mean of main factors, p. 36

Table

5.13 SMART 1999, p. 37

Table

5:14 SMART 1999 Ranking of portfolios, p. 37

Table

5:15 SMART 1999 Mean of main factors, p. 37

Table

5.16 SMART 2000, p. 37

Table

5:17 SMART 2000 Ranking of portfolios, p. 37

Table

5:18 SMART 2000 Mean of main factors, p. 37

Table

5.19 SMART 2001, p. 38

Table

5:20 SMART 2001 Ranking of portfolios, p. 38

Table

5:21 SMART 2001 Mean of main factors, p. 38

Table

5.22 SMART 2002, p. 38

Table

5:23 SMART 2002 Ranking of portfolios, p. 38

Table

5:24 SMART 2002 Mean of main factors, p. 38

Table

5.25 SMART 2003, p. 39

Table

5:26 SMART 2003 Ranking of portfolios, p. 39

Table

5:27 SMART 2003 Mean of main factors, p. 39

Table

5.28 SMART 2004, p. 39

Table

5:29 SMART 2004 Ranking of portfolios, p. 39

Table

5:30 SMART 2004 Mean of main factors, p. 39

Table

5.31 SMART 2005, p. 40

Table

5:32 SMART 2005 Ranking of portfolios, p. 40

Table

5:33 SMART 2005 Mean of main factors, p. 40

Table

5:34 SMART 1995-2005 (average: 14,73, AFGX: 15,56), p. 40

Table

5:35 SMART 1995-2005 Summary for main factors, p. 40

Table

5:36 Standard Deviation, p. 41

Table

5:37 Ranking by Sharpe Ratio, p. 41

Table

5:38 Ranking by Mean Returns, p. 41

Table

5:39 Summary of statistical data, p. 42

Table

5:40 Correlation with actual values, p. 42

Table

6:1 Winning portfolios each year, p. 45

Appendix A

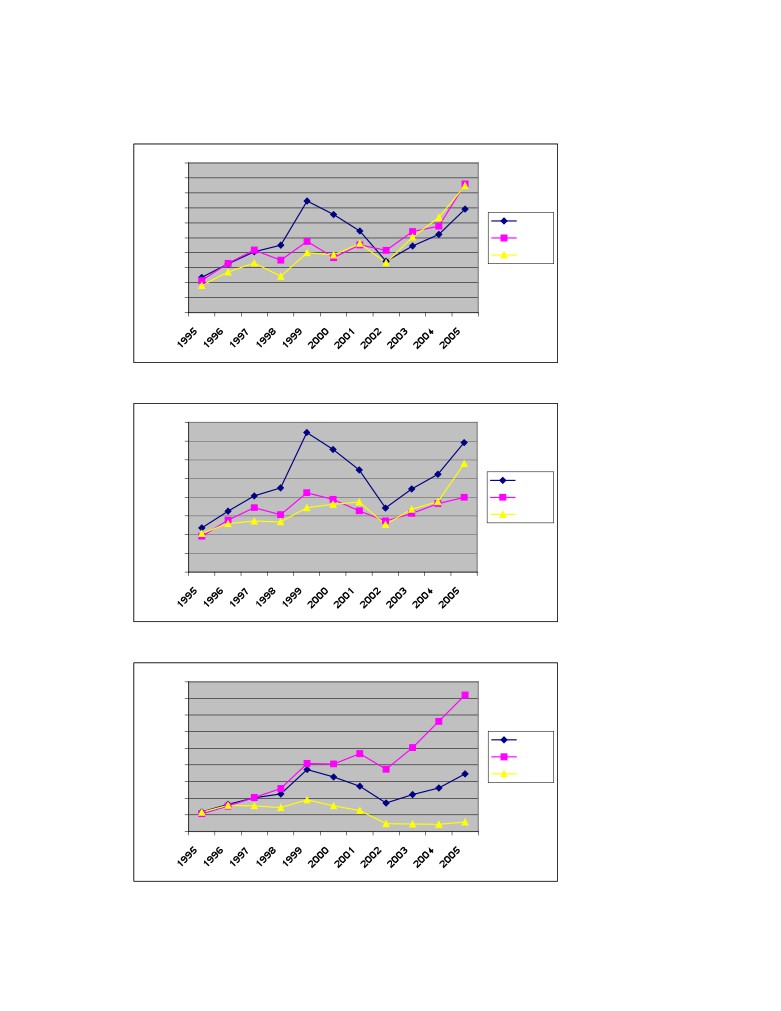

Figure A:1 Total return from starting value of 100 for L-H-H, L-H-L, p. 63

Figure A:2 Total return from starting value of 100 for L-M-H, L-M-L, p. 63

Figure A:3 Total return from starting value of 100 for L-L-H, L-L-L, p.63

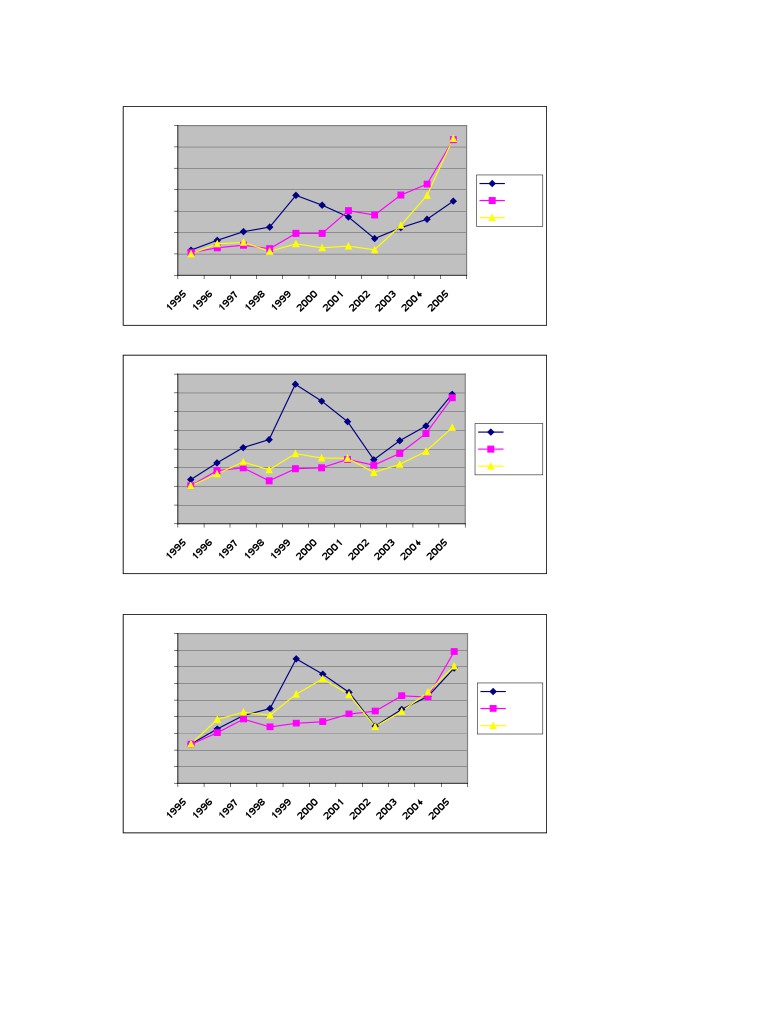

Figure A:4 Total return from starting value of 100 for S-H-H, S-H-L, p.64

Figure A:5 Total return from starting value of 100 for S-M-H, S-M-L, p.64

Figure A:6 Total return from starting value of 100 for S-L-H, S-L-L, p.64

Figure A:7 Total return from starting value of 100 for Large, Small and AFGX, p. 65

Figure A:8 Total return from starting value of 100 for B/P High, B/P Medium, B/P Low and AFGX, p. 65

Figure A:9 Total return from starting value of 100 for Momentum High, Momentum Low and AFGX, p. 65

Figure A:10 Total return from starting value of 100 for SMART, L-L-H and AFGX, p. 66

═════════════════════INTRODUCTION═════════════════════

1 INTRODUCTION

In this chapter the reader is introduced to the background of our study. A discussion

will lead forward to a specific problem and a suggestion of a model which will be the

objective to evaluate during this thesis

1.1 Background

In Finance research there has been a long debate whether markets are efficient or not, and if it

is possible to earn abnormal returns by using a special model or strategy. When a variable is

able to predict returns again and again on the stock market it speaks against the Efficient

Market Hypothesis and is therefore called an anomaly. Several well known examples of

anomalies exist; The January effect (stocks have higher returns during this month), The Small

firm effect (small companies generates higher returns than large companies), The P/E effect

(Low P/E stocks have higher returns than High P/E stocks), Neglected firm effect (the market

sooner or later discovers firms that are in good standing but have been overlooked by the

market), Book-to-Market effect (stocks with a high ratio for B/M or B/P have abnormally high

returns).2 Some argue that several of these are actually related to each other and that they

more or less overlap one or more of the others to some degree, or even absorbs another like

Reinganum claimed Size did to the P/E effect.

Doing research on market anomalies is not just about finding ways to make abnormal profits,

it also serves as a process to help eliminating them and making financial markets more

efficient. And the more rational financial markets behave, the more predictable they will be,

and the more predictable they are the less risky it will be for individuals to place their funds in

stocks. If markets are irrational and unpredictable shares will at different times be either

under- or overvalued which means that some individuals placing their savings in stocks will

make great profits while others will suffer losses. When the outcome of investing in the stock

market seems uncertain or even random, investors will demand higher returns, pushing prices

downwards. The outcomes of all factors affecting share prices of course cannot be fully

predicted, but market anomalies make prices behave even more volatile. The rational for the

existence of financial markets is to allow individuals to allocate their funds over time by

saving or borrowing in order to maximize their utility. When the prices of stocks are lower

than they would be than in a world with efficient markets, it means that individuals will be

pushing forward more of their life time consumption than necessary which means that their

total wealth seen over a lifetime, will be lowered. Therefore, it can be concluded that market

anomalies are bad for individuals and for society as a whole. By shedding light on the

irrationalities present in stock markets, they should eventually go away. This way resource

allocation will work more efficient and individuals will be better off.

In our thesis we will concentrate on three of the above mentioned anomalies. Many research

articles give evidence that simple trading strategies based on anomalies can actually be used

to earn abnormal returns. Firm Size and the B/P ratio can be used to earn higher returns than

one should expect based on CAPM. These anomalies are incoherent with the Efficient Market

2 Bodie, Z. Kane, A. Marcus, A. Investments - 6th International Edition (New York: McGraw-Hill/Irwin, 2005),

p. 389-396

1

═════════════════════INTRODUCTION═════════════════════

Hypothesis (EMH). A common strategy in practise is also to use Momentum Based Strategy

(MBS) and take advantage of trends in the market. None of these should be possible to exploit

if the markets were fully efficient, any abnormal profit opportunities would be arbitraged

away and disappear with time. However this does not seem to be the case for the three factors

that are the foundation of the model we are going to test in this thesis. Their effects does not

seem to fade away with time. We are going to study if the combination of these anomalies

would create even larger abnormal returns, or if they somehow level out each other and are

only useful if used one at a time? It will be done by testing a model that will reveal if any

combination of these factors are especially interesting in the eyes of an investor. The name we

came up with for this model was SMART, Size- Momentum- and Anomaly Ratio Technique.

The name SMART means the same thing in both Swedish and English. If we play around

with the word and spell it backwards something amusing happens, “TRAMS”, which in

Swedish means “RUBBISH”. Let’s just hope we don’t get the latter result when testing our

model..

In the research articles we based the theories on the Size and B/P effects are often studied

simultaneously, and usually in attempts to test the CAPM model and Beta. To initiate the

reader to the subject we present the textbook description:

“The tendency for stocks of firms with high ratios of Book-to-Market value to generate abnormal returns.”3

“Fama and French found that after controlling for the size and book-to-market effects, beta seemed to have no

power to explain average security returns. This finding is an important challenge to the notion of rational

markets, since it seems to imply that a factor that should affect returns – systematic risk – seems not to matter,

while a factor that should not matter – the Book-to-Market ratio – seems capable of predicting future returns.”4

When reading Fama & French and others, we often see the words Cross-section analysis and

Time-series analysis. This could be a good time to clarify these for the reader. Cross-section

data are a collections of data like prices on stocks or market values, at a specific point in time.

We will study the values of Size, B/P and Momentum at the end of each year and therefore

this study could be characterized as a Cross-sectional study. Time-series presents changes

over time of one particular variable, for example the price of one stock over time.5 Since a

Cross-sectional study like the one we have done, with historical values and ratios, involves

many problems with gathering data and getting the right data it’s not possible to completely

simulate historical situations on the market. There will be biases in testing and missing data

for stocks etc that we need to discuss later on. But we are quite sure that we have sufficient

data for the SMART model to be tested properly. For the period 1995-2005 we have gathered

data on nearly 140 stocks that are or have been located on the Swedish stock exchange, more

specifically on the A-list. For different reasons, that will be discussed more later, the number

is reduced to between 50-100 each year that will actually be included in the portfolio

formation that will be an essential part of testing the SMART model. There are more stocks

on the A-list during the first half of the studied period than on the second. A total number of

132 portfolios of stocks will be combined during 11 years (1995-2005) which in other words

means a lot of time in front of the computer screen rather than in the sunlight.

3 Bodie, Z. Kane, A. Marcus, A. Investments - 6th International Edition (New York: McGraw-Hill/Irwin, 2005),

p. 1048

4 Bodie, Z. Kane, A. Marcus, A. Investments - 6th International Edition (New York: McGraw-Hill/Irwin, 2005),

p. 392

5 Watsham, T. J. & Parramore, K. Quantitative Methods in Finance. (Oxford: Thomson Learning), p. 42

2

═════════════════════INTRODUCTION═════════════════════

1.2 Problem discussion

Different articles proposed several explanations for the Size and B/P effects but a majority of

them agreed that these effects are real and existed both in USA and internationally.

Furthermore there is much evidence that the Momentum Based Strategy (MBS) consistently

produce abnormal returns. The foundation for MBS is that the performance of stocks follows

trends in the short run. Therefore you could “ride the wave” and buy winners in an upward

trend, and without much analysis get good returns during shorter holding periods. Our idea is

to combine Size, B/P and MBS into one model and test it on the Swedish stock market to see

if this would produce abnormal returns comparable to the individual effects of the factors, or

if we discover that combinations of them actually reduce or enhance the returns. Would it be

possible to get considerably higher returns than the market index by combining anomalies?

Could it have been possible to earn very high average return on the Swedish market between

1995-2005, by using only the values of three anomalies as a foundation for an investment

strategy? This should not be possible according to EMH since the effects should disappear

when discovered. This will be the main scientific problem area we will seek an answer to. For

this purpose we developed SMART, which is a model that specifies all possible combinations

of Large/Small Size - High/Medium/Low Book-to-Market - High/Low Momentum. By this

approach we will be able to detect any superior permutations based on the historical data.

1.3 Objective

The objective of this thesis is to evaluate if it is possible to earn abnormal risk-adjusted

average returns by using one or more of the combinations suggested by our SMART model.

1.4 Delimitations

We will study the stocks listed on the A-list on the Swedish stock exchange during the period

1995-2005. Looking at a longer time span would normally increase the accuracy of the

results, but there are several reasons for limiting the sample period to the period that we have

chosen to work with. First of all, the data for the years preceding

1995 are not as

comprehensive as those for 1995 and forward. Another reason to start at this year is that the

early nineties were characterised by changes in tax regulations, in monetary regulations and

by a sharp recession. We envisioned that all this turbulence could bring to much noise into the

dataset, and as the reason for including more observations would be to increase the reliability

this could very well be counterproductive. The momentum effect has also already been

documented by Rouwenhorst up until 1995 on the Swedish stock market which means that we

would not make any contribution to this area of research by including years prior to this date.

The results derived from the model will be valid for this period, but may or may not be

applicable during other time periods or in other countries.

There are more known anomalies than those we investigate in this thesis. The reason we

chose to focus on the momentum, size and book-to-market effects will be described in detail

in chapter

3.9.1 but in sort it was mainly because they are the most documented and

researched anomalies that can be combined into a portfolio strategy. The Small firm January

effect can not be used when investing with a one year holding period and the P/E effect - as

will be seen in chapter 3.6 - has been shown to disappear when controlling for the Size effect.

3

═════════════════════INTRODUCTION═════════════════════

1.5 Target audience

Students and professionals interested in finance and investment, especially in ratio analysis

and portfolio management, but also economists and other audiences interested in efficient

markets and behavioural biases.

1.6 Disposition

This thesis will start with a description of the methodology used to investigate the

components of the SMART model. Then we continue with a theoretical orientation and a

historical research overview of the field. This will build a foundation for the development of

the SMART model. We will then present the empirical findings and then comment on these in

the analysis and link it with the theories. Finally we draw conclusions and test if the

hypotheses holds or not and which implications this may have. The disposition of this thesis

could be represented as a drop-down list of topics that will illustrate their position in the

thesis, as well as preparing the reader for what to come.

Method -> Orientation -> Development -> Empirical findings -> Logical conclusions

Introduction

SMART

Analysis

Theories

Methodology

1995-2005

Conclusions

Hypotheses and models

Mean results

Recommendations

Efficient Market Hypothesis

Rankings

Size effect

Momentum effect

Anomaly ratio

Risk measures

Treatment of data

4

════════════════════METHODOLOGY═════════════════════

2 METHODOLOGY

In this chapter we present the various method choices we have made in an attempt to

succeed in answering the objective of this thesis. We will also motivate these

selections. We start with a statement of preconception and describe the approach we

have chosen, and how we have conducted this study with gathering of information

and analysis of data.

2.1 Preconceptions

Past studies, interests and experiences influences how we act and react to the environment

around us. Therefore it could be interesting for the reader to know a little about our

background. Both Björn and Fredrik are, at the time of writing this thesis, in the end of our

studies at the master year in Finance & Control. Among others, the master’s program includes

the courses Investments, Corporate finance and Analysis of financial data during which

market efficiency and anomalies have been examined. Björn has also taken a course in

financial economics on a bachelor level which also touched these areas. Fredrik has in

addition studied various business courses on the bachelor level abroad at APU in Cambridge

(England). Another thing we have in common except our current studies, is our high school

background from natural science studies, a field which’s methodologies we have used in this

thesis. We have not worked in the field of finance but Fredrik has stock investment as a hobby

(and is a firm believer in Momentum Based Strategy) and both of us are interested in working

within the field of finance in the future. This should however not undermine our ability to

value and analyse the results objectively, rather the opposite. Since we are very interested in

this field and the ability to use the results from this thesis for our own gains, our motivation

for producing highly accurate data is particularly strong. Finally, it should be mentioned that

neither of us believes in the absence of behavioural biases in securities markets, we simply do

not believe in the existence of the homo economicus.

2.2 Scientific ideals

There are several ideals or schools in the scientific community, but since this is a thesis in

finance and not scientific philosophy we limit ourselves to justify the choice between the two

main ideals usually discussed. This thesis is positivistic in nature. Positivistic derives from the

Latin word positivus and means determined or known. The term is closely related to natural

science. When you follow this you value secure, objective and measurable knowledge.6 We

intend to test, reject and verify theories with the aid of historical data in an objective manner,

which is why the positivistic approach will suit this thesis well. The hermeneutic school is

concerned with interpretation where you use you own preconceptions as a subjective tool for

understanding a problem that can’t be quantified or reduced easily to testable hypotheses or

figures. Since we want to avoid subjective biases this method will not be appropriate for this

kind of study. Furthermore the very essence of the raw information we use in our study is

simply numerical representations of reality from the beginning, without much need for

translation or interpretation to understand what it represents. With that said and done we can

start our journey to the more interesting parts, at least from the investors standpoint, that is.

6 Franke-Wikberg, S. Vetandets Vägar (The Ways of Knowledge), (Lund: Studentlitteratur, 1994),

p. 323

5

════════════════════METHODOLOGY═════════════════════

2.3 Scientific approach

In scientific research you usually distinguish between the traditional (quantitative) and the

qualitative method. We will collect and analyse quantitative data and therefore the

quantitative method is the obvious choice. In an argumentation that uses deduction you go

from the general to the specific, when using induction you go in the opposite direction from

the specific to the general.7 In other words we will in this thesis move from theory mainly

based on the American environment to the empirical part based on the Swedish environment,

to see how well the theory applies to the Swedish stock market. Furthermore we will test

hypotheses based on the theoretical foundation which is why a deductive approach is more

appropriate for us than an inductive, where you use empirical findings to build a theory. We

already have a theory and a model based on that theory we want to test and therefore the

deductive approach comes naturally.

2.4 Contribution

The empirical part of this thesis will concentrate on the Swedish stock market, or more

specifically on the A-list, where the large and frequent traded companies are listed. Thy

theoretical foundation will be largely influenced by American articles and research, simply

because there is an abundant number of articles concerned with that market and even narrow

subjects usually have relatively much information to build on.

There is much less research on the subject of this thesis done on the Swedish stock market

than on American financial markets. Therefore we will contribute to the field of research by

comparing how accurate and transferable the American research is to the Swedish market on

this particular topic. This thesis will especially expand the knowledge in the way market

anomalies interact, and the focus lies on the Size effect, Momentum and Book-to-Market

(B/P) ratio. As we have not found any research on the momentum effect on the Swedish stock

market subsequent to 1995, we believe that we will make an important contribution in this

area. In general terms our intention is to contribute with knowledge regarding investment

strategy. Our aim is to produce practical knowledge that can be applied in reality for both

private and professional investors.

2.6 Literature search

There is a vast amount of articles produced that are related to the research topic of this thesis

in one way or another. Among the first articles we read were the ones of Penman and Fama &

French, citations from these then led us to a large number of other articles that could have

potential to be included in the thesis. These articles also had a lot of interesting references and

together with the articles found through searching with Google, Business Source Premier,

Lund University Dissertations Abstracts, etc, the problem was not to find enough relevant

articles but to narrow it down and to know which ones that were most important to include.

When searching databases and the web, the keywords we used predominantly were of course

related to the three anomalies like “firm size effects”, “anomalies” “B/M”, “B/P”, “book to

market”, “price to book”, “momentum”, "small firm effect", "abnormal returns", "momentum

7 Sellstedt, B. Metodologi för Företagsekonomer - Ett Försök till Positionsbestämning (Methodology for

Business Administrators - An Attempt to Take a Stand), http://swoba.hhs.se/hastba/papers/hastba2002_007.pdf,

p. 64 (2006-04-18)

6

════════════════════METHODOLOGY═════════════════════

investment", "portfolio strategy", "market efficiency" as well as searching for the exact

authors or articles mentioned repeatedly in other articles. Relatively early we found a great

page at Duke University (The Fuqua School of Business, Top10 ranked in USA) which had

references to high quality research articles that could be relevant for our study. They had a

special page for “PhD Seminar in Empirical Accounting Research” where several of the most

important articles used in this thesis can be found and downloaded.8 This enabled us to gain a

better focus on relevant articles. We also found a paper called “A Price To Book Model Of

Stock Prices”9 which had a brilliant overview of the research progress in this area that also

mentioned many of the articles found on the Duke University page. This should ensure that

our theories are based on the most respected articles in the field.

2.6.1 Source criticism

As stated above, we have tried to use articles already recommended by well-known authors.

While doing this we also found out that many articles were mentioned repeatedly in other

articles. This cross referencing gave us an idea of which articles were most respected and used

in the academic research, therefore we have based our theoretical chapter heavily on those

articles. Almost all of the articles used for this thesis have been published in financial journals

which should serve as a certification for their reliability. This combined with the use of recent

articles and our aim to always use the primary source when possible is according to us a good

quality ensuring procedure. There is always the risk of misinterpretation and personal bias

when collecting information, especially from advanced articles, but since we have used many

sources and read several articles and their interpretations of the main research work, we

should have eliminated this error to a great extent.

8 Duke University, PhD Seminar in Empirical Accounting

9 Branch, B. Sharma, A. Gale, B. Chichirau, C. Proy, J. (2005). A Price To Book Model Of Stock Prices,

University of Massachusetts, http://www.westga.edu/~bquest/2005/model.pdf

7

══════════════THEORY AND THE SMART MODEL═══════════════

3 THEORY AND THE SMART MODEL

In this part we will discuss the theories and controversies that leads forward to the

SMART investment model and finally the hypotheses of this thesis

3.1 Theories

A theory is a collection of related concepts or definitions with the purpose to explain, interpret

or predict something. The key difference between a theory and a hypothesis is that theories

are more complex and abstract in nature. Theories are tools that we can use to orient

ourselves.10

3.2 Models

It's not always easy to determine what is a model and what is a theory. One could say that

Models are representations of something while a Theory is an intention to explain that

something. A theory can use a model to explain a phenomenon. Sometimes a problem can

arise that is related to a model's mathematical representation. The model could give a result

that is only valid within two boundaries.11

This is a typical problem discussed when testing the CAPM model. It does not appear to be

valid in the extremes, just like returns are not normally distributed in the extremes, and hence

the normal distribution, and standard statistical tests based on it, can not be used when

examining returns. Investment strategies involving Size, Momentum, and Book-to-Market

appears to be more successful than they should be according to the CAPM, and a common

explanation is that the model’s mathematical representation have problems and therefore can

not make accurate predictions when these anomalies are used in investment strategies, and

therefore it appears like these strategies produce abnormal returns. We will try to use this to

find an investment strategy that consistently produces higher returns than we should expect.

This thesis will investigate anomalies that the CAPM don't predict well.

3.3 The Capital Asset Pricing Model

The CAPM is a famous model that states that returns should be related, or more correct,

proportional to systematic risk. In our opinion CAPM is a fairly good tool, but we do not

believe it is very useful for special cases like the anomalies that our SMART model resides

on. It is nevertheless important to understand the basic concepts of it because many of the

theories and arguments in this thesis will be linked to the CAPM model.

According to the CAPM, the risk of holding securities can be separated into two types:

Diversifiable risk and systematic risk. By forming portfolios, any firm-specific risks can be

effectively eliminated. According to the CAPM, because it can be diversified, exposure to

firm-specific risk does not require a risk-premium. Systematic risk, which measures the extent

10 Sellstedt, B. Metodologi för Företagsekonomer

- Ett Försök till Positionsbestämning

(Methodology for

Business Administrators

- An Attempt to Take a Stand), SSE/EFI Working Paper Series in Business

Administration No 2002:7, Stockholm School of Economics.

URL: http://swoba.hhs.se/hastba/papers/hastba2002_007.pdf, p. 70 (2006-04-18)

11 Op. Cit

8

══════════════THEORY AND THE SMART MODEL═══════════════

to which security returns are correlated with market return, on the other hand do justify a risk

premium because it can not be eliminated.12

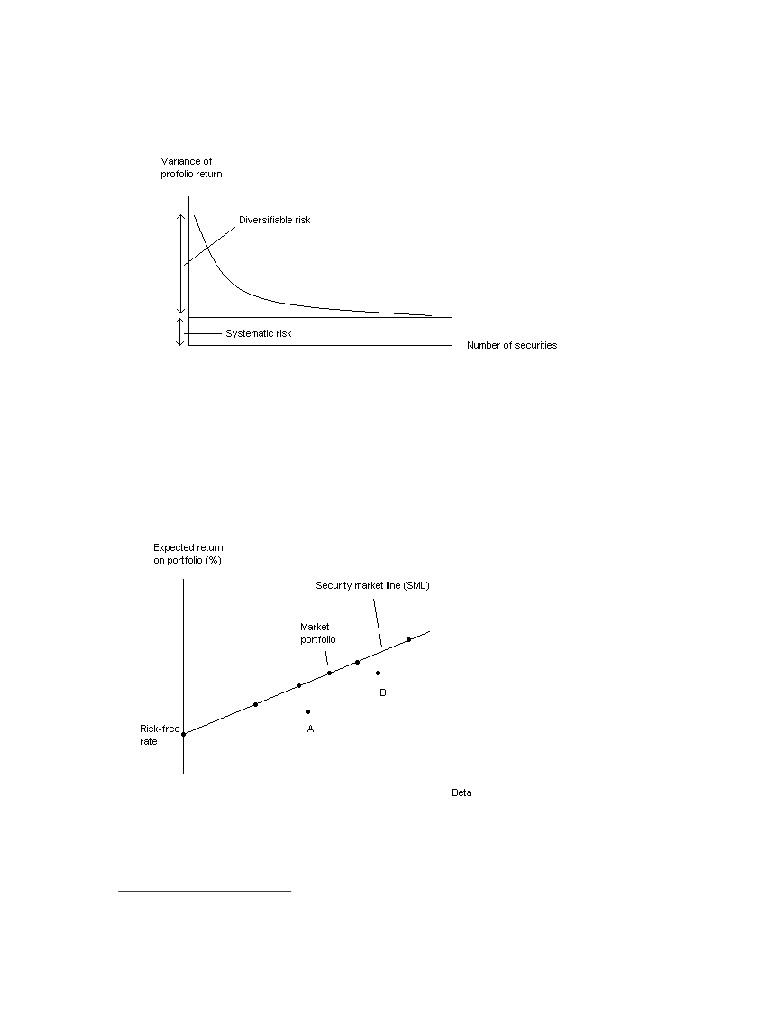

Figure 3.1 Diversifiable risk and Systematic risk.

Important assumptions behind the CAPM are the existences of a market portfolio and of risk-

free borrowing and lending. The market portfolio consists of value-weighted portions of all

securities and will by market mechanisms - where prices adjust to levels where all securities

have the right expected return -become the optimal portfolio to hold. Because the market

portfolio can be combined with risk-free borrowing and lending, a security must lie on the

SML. Portfolios A and B, which are situated below the SML can both be dominated by a

combination of holding the Market portfolio and risk-free borrowing or lending.

Figure 3.2 Security Market Line (SML).

The expected return of a security is by the CAPM expressed by the following formula:

Ri = Rf + βi x (Rm - Rf)

12 Bodie, Kane, Marcus, Investments - 6th International Edition (New York: McGraw-Hill/Irwin, 2005), pp. 224,

282.

9

══════════════THEORY AND THE SMART MODEL═══════════════

Where the only source of risk that is being compensated for in the form of higher expected

return is covariance with the market.13

Empirical tests of the CAPM shows that beta, or covariance with the market, is actually not

the only source of risk that carries a risk-premium. Regressions of the form:

Ri - Rf = γ0 + γ1βi + γ2σ²(ei)

Where the hypothesis is that, γ0 and γ2, the intercept term and the coefficient for firm specific

risk, are both equal to zero, which means that all variability in return should be explained by

beta. The tests however show that in reality, the intercept is significantly positive and the

slope pf the SML is too flat for the CAPM to be valid.14

3.4 The Fama and French Three-Factor Model

The Fama and French three factor model is a regression model with three variables (multiple

regression) often discussed in the theoretical research in the field of finance related to this

thesis. We therefore present it here as a support for the reader. It is not necessary to fully

understand this to be able to interpret the results, but it may be useful for interested readers

that desire to get an in-depth understanding of the debate and controversies around the topic.

For us as authors, we felt obliged to study this in more detail to understand what exactly many

of the articles were trying to convey.

In empirical tests, it has been noted that on average, small firms tend to outperform large

firms and that firms with a high Book-to-Market ratio tend to outperform firms with a low

such ratios. Fama and French argued that these two factors may capture sensitivity to risk

factors in the macro economy and constructed a new model intended to predict security

returns.15 Apart from the market return, which the CAPM is singly based on, Fama and

French included two additional factors namely the SMB and the HML.

The SMB factor, which measures the difference in return between the stocks of companies

with small and large market capitalization, is calculated by subtracting from the return on

small companies, the return on large ones. Similar to the way in which the risk-free rate is

subtracted from the market rate in the CAPM. The HML factor, or the difference in historic

returns of firms with high Book-to-Market value and firms with low value, is calculated by

subtracting from the return one third of the companies with the highest values, the return on

the companies with the lowest values. The model has the following form:

E(Ri) - rf = ai + bi[E(Rm) - Rf] + siE(SMB) + hiE(HML)

Where (E) stand for expected. Regressions ran over the years 1929 to 1997 and the Three-

factor model showed that all of the coefficients were significant, with R-square statistics all

exceeding 0.91.16 Further evidence on these factors and some deeper discussion will be

provided in succeeding chapters.

13 Bodie, Kane, Marcus, Investments - 6th International Edition (New York: McGraw-Hill/Irwin, 2005), pp. 282-

293

14 Op. Cit, p. 418

15 Op. Cit, p 360

16 Bodie, Kane, Marcus, Investments - 6th International Edition (New York: McGraw-Hill/Irwin, 2005), p 429-

430

10

══════════════THEORY AND THE SMART MODEL═══════════════

3.5 Market efficiency

It is absolutely essential to know and understand the basic concepts behind the Efficient

Market Hypothesis and it’s implications for investment strategy to be able to analyse our

thesis. Here we will only provide a brief overview of the theory. For the interested reader a

vast amount of information is available on the topic with just a few clicks on the mouse so to

speak. Furthermore, we also believe that the readers interested in this thesis are already quite

familiar with the Efficient Market Hypothesis. Even so, it is always good to refresh the

memory.

In a truly efficient market, the prices of securities traded in that market will at all times equal

their true investment values. Because of this, no investor, no matter how skilled he or she is,

and no investment strategy, no matter how sophisticated, will be able to beat the market. A

typical schoolbook definition of the concept is given by Sharpe, Alexander and Bailey in their

book Investments:

A market is efficient with respect to a particular set of information if it is impossible to make

abnormal profits (other than by chance) by using this set of information to formulate buying

and selling decisions.17

With this definition, all tests of market anomalies are seen as tests of market efficiency,

because in an efficient market no anomalies should exist. At least not to a degree where

abnormal risk-adjusted profits can be made by implementing a strategy exploiting market

anomalies. For example, already in 1981, Banz showed that the expected return was higher

for firms with small market capitalisation than for firms with large market capitalisation.18

This does not however prove that markets are inefficient, because the size of a company may

be correlated with some other source of risk, causing investors to demand higher profits to

adjust for higher risk when investing in small cap firms.

Market efficiency is commonly described in three forms19:

1. Weak efficiency, meaning that abnormal profits can not be made using information

about historic prices. This means that technical analysis is ineffective in predicting

returns, which in turn entails that momentum investing, a strategy we will describe

later on in the theoretical framework and finally test empirically, will not be effective.

2. Semi-strong efficiency, under which it will not be possible to make abnormal profits

by using publicly available information about companies. This implies that the size-

effect and the Book-to-Market anomaly should either be non-existing or that the

market capitalisation and Book-to-Market ratios carry some information about risk.

We will later go into these anomalies in detail.

3. Strong efficiency means that share prices at all times reflects all public and private

information.

17 Sharpe, F. Alexander, G and Bailey, V. (1999). Investments, p. 93

18 Fama, E.F. & French, K.R. The Cross-Section of Expected Stock Returns

(The Journal of Finance, Vol. 47 No 2 June 1992), p. 427

19 Sharpe, F. Alexander, G and Bailey, V. (1999). Investments, p. 93

11

══════════════THEORY AND THE SMART MODEL═══════════════

3.6 The Size effect

It’s been well documented in many research articles that a firm’s size has a siqnificant effect

on the stock returns. Small firms generally generate higher shareholder returns than big

companies. Why this is so, has for a long time been a topic of debate in the academic world,

and some even question that the effect exists as it has not always been found to be significant.

There are actually some indications that the small firm effect might not be valid for the

Swedish stock market (or at least be less pronounced), still, the authors of this thesis are rather

convinced by our own “non-statistically” observations that this is the case. As an example we

have seen that the small company funds on the Swedish market (and internationally) are

usually the best performers over longer time periods. This is of course, at least before writing

this thesis, mainly based on our own limited experience, and not scientific research. Anyway,

we will now present the academic view on this topic.

One common explanation for this is that these firms carry a risk premium which investors are

compensated for by higher returns.20 This is not a new discovery. Reinganum documented

empirical anomalies in 1981 which suggested that either the capital asset pricing model

(CAPM) is misspecified, or that capital markets are inefficient. Portfolios based on firm size

or earnings/price (E/P) ratios produced average returns systematically different from what

CAPM predicted. Reinganum also noticed that the effect was not temporary but remained at

least two years into the future. He state that in his opinion the result reduces the probability of

the size effect being generated by a market inefficiency. Based on the study he did he believes

the equilibrium pricing model is wrongly specified rather than that the market is inefficient.

We agree with the conclusion that the equilibrium pricing model being invalid at least in the

extremes, but don’t agree that markets are efficient. The data also revealed that the E/P effect

did not appear when returns were controlled for the size effect. The firm size effect largely

absorbs the E/P effect. Both of these anomalies exists when studied separately, but they seem

to be related to the same set of missing factors. Reinganum therefore conclude that these

factors are probably more closely linked with the firm size than the E/P ratio.21

Accoring to Reinganum two researchers, Leong & Zaima, reported in 1991 that studies have

found that the firm size, measuered as the total market value of equity, is negatively related to

excess returns. In other words big companies generate lower shareholder returns than small

companies. In their own studie they also concluded that the portfolio with the smalles market

value (MV) consistently outperformed the large market value portfolio. The result was

consistent with earlier studies.22 Usually the studies find that there is no big difference in

returns between medium and large firms, but for small firms there is a strong effect. However

Leong & Zaima could not find evidence of a small firm effect on the OTC list (where the

much smaller firms are located). This indicates that the size effect may only apply to the small

companies on the large company lists. On the Swedish stock market this would mean that we

should only expect to find the small firm effect on the A-list but not on the O-list, if the

20 Drew, M. E. Veeraraghavan, M. Beta, Firm size, Book-to-Market equity and Stock Returns ( Journal of the

Asia Pasific Economy, Vol. 8 No 3 October 2003), p. 376

21 Reinganum, M. R. Misspecification of Capital Asset Pricing - Empirical Anomalies Based on Earnings' Yields

and Market Values (Journal of Financial Economics, Vol. 9 No 1 March 1981), p. 19

22 See Banz (1981), Reinganum (1981, 1983) and Brown, Kleidon and Marsh (1983) for NYSE-AMEX stocks.

12

══════════════THEORY AND THE SMART MODEL═══════════════

results could be transfered to the Swedish stock exchange.23 Many other researchers also

confirms the existence of the size effect to this day.24

3.6.1 Summary of findings regarding the size effect

There is some discussion on the existence of a Size anomaly. Without doubt there is as Size

effect, but whether this is really an anomaly or if the effect arises because of justifiable risk

premiums has not been fully established. The CAPM cannot explain the excess return on

small firm shares, but this model has been rejected by the majority of the community of

financial researchers. The Size effect has been shown to be closely connected to the P/E effect

and there is some evidence saying that the differences in return only exist between the really

large companies and smaller ones.

3.7 The Momentum effect

Pick the winners and throw away the losers. That is the basic idea of momentum investing.

More exactly, momentum investing exploits the market anomaly that shares having performed

the best over the last 3 to 12 months, on average will outperform index for the upcoming

months.

This anomaly was first discovered by the academic world in 1993 by Jegadeesh and Titman

and the existence of it has thereafter been confirmed in several independent studies using

datasets from both developed and emerging markets.25 A survey of mutual fund investors in

1995 indicated that 77 percent of US mutual funds used momentum as a stock selection

criteria, it shows that momentum investing more than just a theoretical model.26 One very

interesting aspect of the momentum effect is that it is reversed when looking at longer time

periods. That is, the winners over the past three to five years tend give less return than index

over the subsequent three to five years while the stocks having performed the worst over the

corresponding time period tend to give the best subsequent return. It appears as if the market

initially under reacts to good news but over some time overreacts and eventually come to its

senses.27

23 Leong, K. K. & Zaima, J. K. Further Evidence of the Small Firm Effect: A Comparison of the NYSE-AMEX

and OTC Stocks (Journal of Business Finance & Accounting, Vol. 18 No 1 January 1991), p. 117-124

24 See Fama & French (1992), Jensen, Johnson, and Mercer (1997), Maroney & Protopapadakis (1999). Bleiser

(2003), and Carlson, Fisher and Giammarino (2004) to mention a few.

25 Bird, R. Whitaker, J. The Performance of Value and Momentum Investment Portfolios: Recent Experience in

the Major European Markets (Journal of Asset Management, Vol. 4 No 4 December 2003), p. 223

26 Taffler, R. Discussion of the Profitability of Momentum Investing (Journal of Business Finance & Accounting,

Vol. 26 No 9/10, Nov/Dec 1999), p. 1093

27 Daniel, K. Hirshleifer, D. Subrahmanyam, A. Investor Psychology and Security Market Under- and

Overreaction (The Journal of Finance Vol. LIIII No. 6 December 1998), pp. 1839-1840

13

══════════════THEORY AND THE SMART MODEL═══════════════

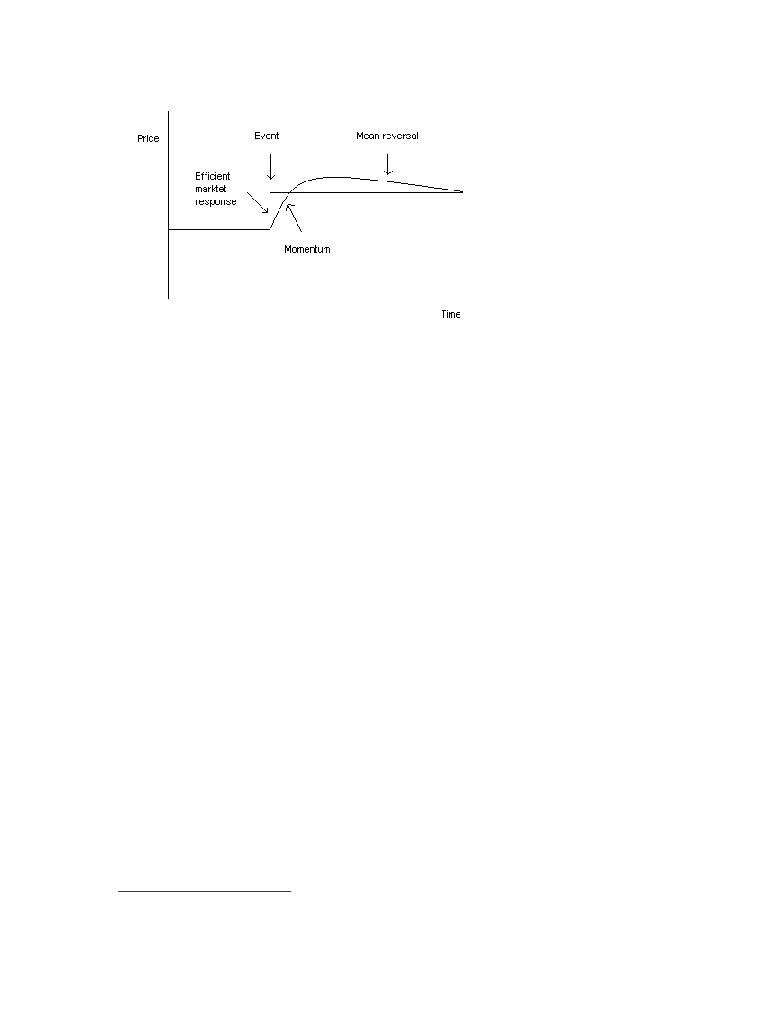

Figure 3.3 Momentum - In the figure, there is an initial under reaction followed by an overreaction and

finally a mean reversal. It can be compared to the response of an efficient market.

3.7.1 Behavioural explanations for the anomaly

Several behavioural explanations for the long term overreaction and the short term

underreaction have been provided since the discovery of the market anomaly. Barberis,

Shleifer and Vishny developed a model where investment decisions are characterised either

by representative heuristic or conservatism. When decisions are characterised by the former,

it means that investors put to much weight on recent data and ignore the more complete

statistical evidence on stock types. This leads investors to overreact to new data. When

characterised by the latter, it means that investors are slow to update their models in the face

of new evidence, this leads them to underreact to new data. In the model, at a given time,

predominant view will either be that earnings are mean-reverting, or that they are trending.

Normally, investors will believe earnings to be mean reverting but their opinion may switch to

thinking that earnings are trending after a string of either positive or negative announcements.

When they switch from being conservative to becoming representative heuristic, investors

will overreact to earnings shocks as they expect subsequent earnings shocks to point in the

same direction as they now believe them to be trending. When a positive string of earnings

announcements has occurred, investors will eventually react less to additionally positive

announcements than to negative such. The reason is that the positive news are already more or

less expected and taken into account. Because positive and negative shocks in reality are

equally likely, the result of this is that the returns on average will be negative for the coming

time period. This causes returns to be mean-reverting. On the other hand, when the belief is

that earnings are mean reverting holds, investors will react less strongly to news pointing in

the opposite direction of previous news than to news pointing in the same direction. This way

the reaction to either positive or negative news will be delayed and a momentum effect will

come about.28

Daniel, Hirshleifer, and Subrahmanyam developed a model in 1998 with two types of

investors: informed and uninformed, where the former is the one that decides prices and the

latter follow his actions. The informed investors suffer from overconfidence and variations in

28 Liu, W. Strong, N. Xu, X. The Profitability of Momentum investing

(Journal of Business Finance &

Accounting, Vol. 26 No 9/10, November/December 1999), p. 1047

14

══════════════THEORY AND THE SMART MODEL═══════════════

confidence arising from biased self-attribution. Daniel, Hirshleifer, and Subrahmanyam

describe an overconfident investor as one who overestimates his or her ability to generate

information and ability to interpret data that others neglect, which leads to overconfidence

about the precision of personal information but not about publicly available information. In

the case when subsequent public information confirms the forecast based on private

information, this will boost the confidence of the investor about his forecasting ability, and

likely cause a further overreaction to the preceding private signal . In the opposite case, when

subsequent public information contradicts the private information, the investor will only

partially correct his forecast. In time, as more public information arrives, the share price will

return to its full-information level. Put together this explains the momentum effect and the

subsequent mean reversal that has been seen in markets for securities.29

Hong and Stein developed a model in 1999 with “newswatchers” and “momentum traders”

where each type is boundary rational, only able to process some subset of the publicly

available information. The newswatchers make forecasts based on signals that they privately

observe about future fundamentals without taking into account current or previous prices. The

momentum trades on the other hand will disregard any news and trade solely on information

on past and current prices, or to be more exact, price changes. When news reaches the market,

information will only gradually spread among the newswatcher population. Because of this

gradual diffusion, share prices will not immediately jump up to their efficient level following

after the release of some set of news about a company, instead they will gradually - as the

information spreads - do so. We now bring the momentum traders into the picture. Because

they observe price changes and therefore are aware of the pattern of price adjustment just

described, they can make money buying stocks of which prices have recently increased. Since

they do not follow the news however, there is no way for the momentum traders to know

whether the price of a share has yet reached its efficient level and they may therefore be

buying an overvalued share when selecting shares after recent performance. Hence, only the

early momentum trades will make gains while the late ones will be making losses. On average

however, it will pay of for the momentum traders to follow the strategy of buying shares that

have increased in price because of the initial underreaction by the newswatchers.30

3.7.2 Empirical evidence of the price momentum effect

The first attempt to formally evaluate the momentum strategy was made in 1993 by Jegadeesh

and Titman when they studied the performance of momentum portfolios on NYSE and

AMEX stocks over the period 1965 to 1989. Jegadeesh and Titman tested the momentum

effect over different time lengths by forming portfolios on the basis of their past return over

the last 3, 6, 9, or 12 months and holding these portfolios for periods of 3, 6, 9 and 12 months.

In total they evaluated 16 (4 evaluation period times 4 holding periods) different momentum

strategies by zero cost arbitrage portfolios, where the losers were sold short and the proceeds

from this used to buy the winner stocks. Among their findings was that the 6 x 6 strategy gave

return of 1% per months, and their most profitable one, the 12 x 3 portfolio, generated a

monthly return of 1.49%. Jegadeesh and Titman also examined if the excess returns could be

explained by differences in systematic risk between past winners and losers but found no such

evidence.

29 Daniel, K. Hirshleifer, D. Subrahmanyam, A. Investor Psychology and Security Market Under- and

Overreaction (The Journal of Finance, Vol. LIIII No 6 December 1998), p. 1844-1845

30 Hong, H. Stein, J. A Unified Theory of Underreaction, Momentum Trading and Overreaction in Asset Markets

(The Journal of Finance, Vol. LIV No 6 December 1999), pp. 2143-2184

15

══════════════THEORY AND THE SMART MODEL═══════════════

In 1999 Liu, Strong and Xu mimicked the methodology of Jegadeesh and Titman evaluating

16 different port folios, using 2434 non financial stocks and weekly observations of prices

from 1977-1998. In their study, The Profitability of Momentum Investing, their discoveries

were similar to those of Titman and Jegadeesh, finding the momentum strategy to be overall

effective and the 12 x 3 portfolio being the most profitable one. Forming zero cost arbitrage

portfolios by short selling past losers and buying past winners annual returns ranged from

10.4 % for the 3 x 3 portfolio to a striking 23.4 % for the 12 x 3 portfolio.31

Since most tests on momentum effects had been performed using US data, Bird and Whitaker

decided to test for this and other anomalies on European stock markets in their study from

2003. Pointing out that most studies had been using data from the 1980s and 90s, during

which time there was an upward trend in stock prices, Bird and Whitaker used data ranging

from 1990 to 2002, including the subsequent market correction. Using 6 and 12 months

evaluation periods they found significant evidence of the momentum effect in all the markets

examined. For portfolios formed on the basis of past 6 month’s performance, the top quintile

outperformed the bottom quintile by 7 % over a nine month period, which was approximately

the optimal holding period. With the 12 month strategy, they found the optimum holding

period to be less than 6 months and the excess return of the top quintile compared to the

bottom to be 4 % over this holding period.32

In 2001 Jegadeesh and Titman replicated their groundbreaking study from 1993 where the

momentum effect was first documented. To ensure that their previous findings were not the

result of data mining, they tested their 1993 model on out of sample data reaching from 1990

to 1998. The data also differed in that it included NASDAQ stocks and excluded low priced

stocks. In this study, 10 different portfolios based on the ranking of return over the past 6

months were formed, these portfolios were then held for a time period of 6 months. The

results were similar to those attained in their pioneering study; the top past winners

outperformed the bottom past losers by 1.39 % over the six month period.33

Fama and French sought to see whether their Three-Factor Model could explain the various

market anomalies found in research in their article from 1996. While successful in explaining

long-term reversals, their Three-factor model failed to explain the mid-term continuation of

price changes. The problem was that stocks having performed badly over the last months

tended to load more on SMB and HML (See section 3.4 for explanation of the abbreviations).

Because the market values of recent losers will diminish, they will start behaving like small

distressed stocks, being small in size and having low book-to-market ratio. This in turn caused

the model to wrongly predict strong subsequent returns.34 Grundy and Martin thoroughly

examined how momentum strategies are related to various factors of risk in 2001. One of the

hypothesises they tested was that the stocks most likely to have performed well in the recent

past would be stocks heavily exposed to factors such as SMB and HML, which would require

a higher expected return. What they found out was that since the factors themselves do not

31 Liu, W. Strong, N. Xu, X. The Profitability of Momentum investing

(Journal of Business Finance &

Accounting, Vol. 26 No 9/10, November/December 1999), pp. 1045-1046, 1051-1057

32 Bird, R. Whitaker, J. The Performance of Value and Momentum Investment Portfolios: Recent Experience in

the Major European Markets (Journal of Asset Management, Vol. 4 No 4 December 2003), pp. 221, 237, 241

33 Jegadeesh, N. Titman, S. Profitability of Momentum Strategies: An Evaluation of Alternative Explanations

(The Journal of Finance, Vol. 10 LVI No 2 April 2001), pp. 699-700, 701-705

34 Fama, E.F. & French, K.R. Multifactor Explanations of Asset Pricing Anomalies (The Journal of Finance, Vol.

LI No 1 March 1996), pp. 63-68

16

══════════════THEORY AND THE SMART MODEL═══════════════

show positive momentum, the exposure to the factors could be hedged away without

sacrificing too much of the profits.35

Rouwenhorst carried out an extensive study across 12 European markets using data from 1978

to 1995 with a total sample size of 2190 stocks. By examining several different markets he

could conclude that the empirical observations of a momentum effect were not due to data

snooping. Consistent with the findings of Jegadeesh and Titman and thoses of Liu, Strong and

Xu, the 12 x 3 portfolio proved to be the most successful strategy. Rouwenhorst also tested to

see if the excess returns on winner portfolios could be accounted for by increased beta-risk or

exposure to the size factor, SMB. He found that the returns persisted even after adjusting for

beta, which was very similar between the winner and the looser portfolio, and that adjusting

for SMB actually increased risk adjusted profits as losers on average were smaller firms than

winners.36

3.7.3 Summary of empirical findings

The existence of a price momentum effect has been documented in several studies, using data

from both different time periods and from different markets. With no convincing evidence

saying the momentum effect would be accompanied by increased risk, there is good reason to

assume that using the momentum strategy of buying past winners and short-selling past losers

should bring abnormal profits. It can be noted that Jegadeesh & Titman, Liu, Strong & Xu and

Rouwenhorst found the most profitable momentum strategy to be the one ranking stocks on

their performance over the last 12 moths and updating the portfolios every 3 months. This

shows that the momentum effect is both universal and also very predictable in its form. In our

study we will use 12*12 because of practical reasons. It would not have been feasible to

rearrange the portfolios every 3 months because it would have quadrupled the workload for

us. It would also in reality mean higher transaction costs, which has been documented by

Olsson to be an important factor to consider. Transaction cost control improves portfolio

performance by 6%-20% relative to portfolios without it.37

3.8 The Anomaly ratio

The ratio of Book value to Price (B/P) has some interesting properties, especially in the

extremes. Penman illustrated that the inverse (high P/B) can be used to predict the level and

stamina of returns, good for estimating future earnings. On the other hand low P/B, or high

B/P which is the notion we focus on, have consistently been proven in empirical research to

predict abnormal stock returns. That is of course especially interesting for us and is the

rational for incorporating it as one of three factors in our SMART model. It is a fairly new

topic in the academic community but since Fama and French initiated the spark there has

quite literally been an explosion of articles around this anomaly. We will try to convey the

progress through the years and if you look at the footnotes you will see that the reported

findings follow a timeline, this is important since this anomaly should disappear when

becoming publicly know, a hypothesis that can be rejected since the reader will find that the

B/P effect is found again and again with no evidence of vanishing.

35 Grundy, B. D. Martin, J. S. Understanding the Nature of the Risks and the Source of Rewards to Momentum

Investing (The Review of Financial Studies, Vol. 14 No 1 January 2001), p. 42-49

36 Rouwenhorst, K. G. International Momentum Strategies (The Journal of Finance, Vol. LIII No 1 February

1998), pp. 268, 270, 277

37 Olsson, R.

(2005). Portfolio Management under Transaction Costs: Model Development and Swedish

Evidence (PhD dissertation, Umeå University), p. 193

17

══════════════THEORY AND THE SMART MODEL═══════════════

Definitions: B = Book value per share, P = Price per share, B/P = Book-to-Market ratio.

For reference the textbook description of the B/P effect mentioned in the introduction to the

thesis is reiterated here:

“The tendency for stocks of firms with high ratios of Book-to-Market value to generate abnormal returns.” 38

According to Penman the B/P ratio received little academic attention until Fama & French

published a frequently referenced article in

1992, The Cross-Section of Expected Stock

Returns. Firms that earn an accounting income at the same rate as the cost of capital will

have a present value of future residual income equal to zero. Firms that don’t create or destroy

wealth relative to the shareholders equity will simply be worth their book value. This implies

that the B/P value for this type of firm should be close to 1.40

In their groundbreaking article from 1992, Fama & French studied B/P and Size effects

related to average stock returns during the 1963-1990 period. They concluded that common

stock returns are related to the company Size and Book-to-Market ratios. Low B/P portfolios

have a tendency to show smaller average returns compared to high B/P groups.41 This result

has received some critique because it could be related to sample selection bias, which means

certain subsets of stocks are not included for different reasons. According to Campbell, Lo,

MacKinlay the main critique comes from Kothari, Shanken and Sloan in their article from

1995. They claim data requirements for studies of B/P lead to bad performing stocks being

excluded which results in a survivorship bias. The poor performing stocks are expected to

have low returns and high B/P while the average return of the included high B/P stocks have a

positive bias. This could have caused the results of Fama & Franch in 1992 but in 1996 this

was disputed by Fama & French. The issue was not resolved and Campbell, Lo and

MacKinlay conclude that researchers should continue to be aware of the potential problems

related to sample selection bias.42 Barber & Lyon state that the accumulating evidence

indicates a positive relation between the B/P ratio and security returns and refers to articles

from Davis in 1994 as well as Chan, Jegadeesh and Lakonishok from 1995 which reached the

same conclusion.43

Fama and French continued their research and in 1998 they studied the difference between

growth and value returns in a international perspective. They constructed a two-factor model

to clarify the mystery around the value premium. As they had stated earlier they found that a

value premium did exists in stock returns, particularly for companies with high B/P and

Earnings/Price-ratios. The results was that high B/P outperform low B/P by a spread of 7,68%

per year.44

38 Bodie, Z. Kane, A. Marcus, A. Investments - 6th International Edition (New York: McGraw-Hill/Irwin, 2005),

p. 1048

39 Penman, S. H. The Articulation of Price-Earnings Ratios and Market-to-Book Ratios and the evaluation of

Growth (Journal of Accounting Research, Vol. 34 No 2 Autumn 1996), pp. 235-243, 252

40 Frankel, R. Charles, M. Lee, C. Accounting Valuation, Market Expectation, and Cross-Sectional Stock Returns

(Journal of Accounting and Economics, Vol. 25 No 3 June 1998), pp. 286-287

41 Fama, E.F. & French, K.R. The Cross-Section of Expected Stock Returns

(The Journal of Finance, Vol. 47 No 2 June 1992), pp. 427-465

42 Campbell, Lo, MacKiley. The Econometrics of Financial Markets (New Jersey: Princeton University Press,

1997), p. 211

43 Barber, B.M. & Lyon, J.D. Detecting Long-run Abnormal Stock Returns: The Empirical Power and

Specification of Test Statistics (Journal of Financial Economics, Vol. 43 no 3 1997), p. 356

44 Fama, E.F. & French, K.R. Value versus Growth: The International Evidence (The Journal of Finance, Vol.

LIII No 6 December 1998), pp. 1975-1999

18

══════════════THEORY AND THE SMART MODEL═══════════════

The B/P effect was again confirmed by Frankel, Charles and Lee in 1998 which report a 12

month return for low B/P stocks of 13,7% and 18,6% for high B/P stocks, and their result is

also seen over longer periods. They also verify that low B/P firms have higher Beta compared

to high B/P firms, and they conclude that the B/P effect therefore is not related to differences

in market risk of the stocks.45 The Beta is also not a constant as originally presumed but varies

with time. Bollerslev, Engle and Wooldridge demonstrated this when they developed a

multivariate GARCH model (Generalized Autoregressive Conditional Heteroskedasticity).46

The fact that the B/P effect is not related to a different market risk is positive for us since we

can create a portfolio of better performing firms without increasing the risk, which according

to literature based on the efficient market theory should be impossible. That is also why the

B/P effect is called an anomaly. But we will use it to our advantage since we are interested in

what works in reality when creating our investment model. After all we are convinced that

people would prefer to make money in reality rather than in theory..

In 1999 Maroney & Protopapadakis also found a positive relation between returns and the

Book-to Market ratio. The B/P effects were international in nature and were also strong under

a general stochastic (involving chance or probability) pricing function that did not depend on

a specific asset pricing model. They also avoided the potentially serious biases that according

to them exist in the Fama & French Three-Factor model. They tried to introduce important

macro and financial variables in the pricing functions but it could not help explain the B/P

effect.47

According to Ashiq, Hwang and Trombley two competing explanations exists for this

anomaly. The first assumes that the anomaly exist because it’s compensation for risk as

suggested by Fama&French in 1992. The second assumes that the return for B/P-based

portfolio strategies derives from systematic miss pricing of extreme B/P stocks. Investors on

the market underestimate future earnings for high B/P stocks and overestimate future earnings

for low B/P stocks.48 They also found that the ability of the B/P ratio to predict future returns

is better for stocks with higher transaction costs and with less ownership by sophisticated

investors. Their result is consistent with the assumption that the B/P effect derives from

market miss pricing. The effect is strongest for stocks with high return volatility. Maybe it's

best illustrated by a direct quote from their conclusions, here B/M is the same as our

definition B/P:

"Specifically, the 10% of stocks in our sample with the greatest return volatility exhibit three-year size-adjusted

return of 51,3% for a portfolio long in the highest quintile of B/M and short in the lowest quintile of B/M; the

corresponding return for the 10% of stocks with least return volatility is negligible 1,7%. Also, the B/M effect for

the high volatility group exceeds that for the low volatility group in 20 out of 22 sample years.”49

Explanations for the B/P effect - or anomaly - is also assumed to be connected to leverage.

Carlson, Fisher and Giammarino argue that the B/P effect can be attributed to operating

45 Frankel, R. Charles, M. Lee, C. Accounting Valuation, Market Expectation, and Cross-Sectional Stock

Returns, (Journal of Accounting and Economics, Vol. 25 No 3 June 1998), p. 298

46 The Royal Swedish Academy of Sciences, Time-Series Econometrics: Cointegration and Autoregressive

Conditional Heteroskedasticity, http://nobelprize.org/economics/laureates/2003/ecoadv.pdf, p.19 (2006-03-16)

47 Maroney, N.C. & Protopapadakis, A.A. The Book-to-Market and Size Effects in a General Asset Pricing

Model: Evidence From Seven National Markets (University of New Orleans, Department of Economics and

Finance - Working Papers 1999-15), http://ideas.repec.org/p/uno/wpaper/1999-15.html, (2006-03-10)

48 Ashiq, A. Hwang, L-S. Trombley, M.A. Arbitrage Risk and the Book-to-Market Anomaly

(Journal of

Financial Economics, Vol. 69 No 2 2003), pp. 355-356

49 Ashiq, A. Hwang, L-S. Trombley, M.A. Arbitrage Risk and the Book-to-Market Anomaly

(Journal of

Financial Economics, Vol. 69 No 2 2003), pp. 371-372

19

══════════════THEORY AND THE SMART MODEL═══════════════

leverage and that it is critical for explaining the magnitude of the return characteristics. They

also state that small firms and high B/P firms have elevated expected returns because of high

leverage. Low B/P portfolios will have lower expected returns compared to high B/P

portfolios.50

What happens to the ratios if we limit the measurement to a recent period strongly influenced

by a market decline? In 2003 Bleser analysed the period January 2000 to September 2003

which included the IT-bubble and was characterised by a bear market trend (a declining

market). They found that during this time portfolios with P/E and P/B below S&P 500 average

performed better. Small firms also performed better than medium and large companies.51 This

confirms the results from Jensen, Johnson and Mercer in 1997 that high P/B is in general not

good during a period of downward market either. We have also presented a considerable